How To Apply and Obtain Palmpay POS Machine

- How To Get Palmpay POS Machine; Price Commission & Charges

Greetings and welcome to another exciting publication about Palmpay POS Services and Machines. Good day dear incoming Palmpay Agents and Merchants, this post is published at a crucial time when cities in Nigeria is seeking financial inclusion in the retail and banking sectors.

Have you been looking for a way to get Palmpay POS and you haven’t been able to get one? Contact a customer care representative to apply for one, it costs ₦30,000 for the button and ₦60,000 naira for the android, click WhatsApp Chat or call 08117390POS

Though I will still share a table with it us, so that we can go through it and understand it very well, I will just point out the important key points.

Types of Palmpay POS and Prices:

Android pos: 60,000

Traditional/Linux/Button pos: 30,000

Targets On Each Palmpay POS:

Android: 40,000 daily

Traditional: 30,000 daily

You have to already have an office, shop, Kiosk, Umbrella stand before you can make the move to secure a Palmpay POS Machine/Terminal. In other words, Palmpay will not give you a pos device if you do not a physical location for your business.

Visit Palmpay

Commission To Agents:

For every withdrawal, your agents do you will be getting a very little slice of profit.

No commission on deposits.

Agents that are dormant for 3days will be terminated and placed on investigation.

Charges To Agents:

Breakdown of Palmpay’s ATM card withdrawal charges;

1k = 5 naira

2k = 10 naira

3k = 15 naira

4k = 20 naira

5k = 25 naira

6k = 30 naira

7k = 35 naira

8k = 40 naira

9k = 45 naira

10k = 50 naira

11k = 55 naira

12k = 60 naira

13k = 65 naira

14k = 70 naira

15k = 75 naira

16k = 80 naira

17k = 85 naira

18k = 90 naira

19k = 95 naira

20k = 100 naira

20k to 1 million naira = 100 naira

Deposit N10 flat rate.

How To Get A Pamlpay POS

There are some documents and personal and business details you will have to get ready at hand when you are ready to apply for the Palmpay POS.

You will have to apply through a PayPal aggregator also known as A Palmpay Business Manager. The following requirements are needed:

SURNAME:

FIRST:

MIDDLE:

Date Of Birth:

GENDER:

EMAIL:

Mobile Phone number:

Alternate Phone number:

ID card Number:

Business Address:

STATE:

L. G. A on Utility bill:

Photo of the owner in front of the shop:

Proof of commercial activity (photo of a Utility bill):

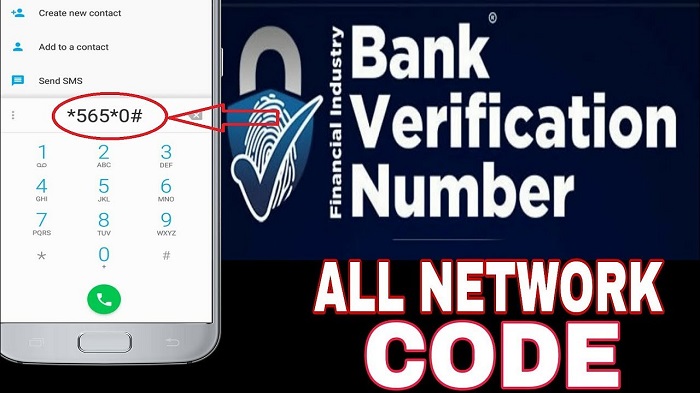

BVN:

Passport Photograph:

Valid Id card(Government approved ID card e.g Voter’s Card NIMC National Identity card, International Passport, and Driver’s License:

NEXT OF KIN DETAILS

Full name

Number

Utility bill

Agreement

NOTE!! The company will be responsible for any software damage on the Pos, whereby there’s hardware damage, the agent will pay for logistics and swapping.

By filling in and submitting these details, you have agreed to the Terms & Conditions.

DO MORE WITH PALMPAY!

PALMPAY POS AGENT AGREEMENT

Palmpay Agent POS Service Agreement

PLEASE READ ALL THE CONTENT OF THIS DOCUMENT CAREFULLY TO ENSURE THAT YOU UNDERSTAND EACH PROVISION BEFORE ACCEPTING THIS AGREEMENT. IF YOU DO NOT AGREE WITH ANYTHING IN THIS AGREEMENT, OR IF YOU CANNOT UNDERSTAND THE MEANING OF A PROVISION ACCURATELY, PLEASE DO NOT CLICK “AGREE & NEXT” OR PERFORM ANY FOLLOW-UP ACTIONS.

BY CLICKING “AGREE & NEXT”, OR OTHERWISE ACCEPTING THESE TERMS, YOU ARE SIGNIFYING THAT YOU HAVE READ AND UNDERSTOOD THE TERMS, AND AGREE TO BE BOUND BY THESE TERMS, AND ALL FUTURE MODIFICATIONS TO THESE TERMS IN THIS AGREEMENT.

THIS AGENT POS SERVICE AGREEMENT (“Agreement”) is entered among PALMPAY LIMITED, a private limited company incorporated under the laws of the Federal Republic of Nigeria together with its parent, subsidiaries, successors, assignees and affiliates, (hereinafter referred to as “PalmPay”), , a private limited company incorporated under the laws of the Federal Republic of Nigeria, (hereinafter referred to as “the Aggregator”) and , the holder of National ID/International Passport/BVN No. ____

3.8 For transactions of N100,000.00 (One Hundred Thousand Naira) and above, the Agent shall ensure that cardholder presents a valid form of identification such as Driver’s license, International passport or other forms of Identification accepted by law before accepting a cardholder’s payment card.

3.9 The Agent shall in addition to 3.8 above, request, document the cardholder’s name; means of identification; telephone number and address and make photocopies of the cardholder’s mean of identification for all transactions of N100,000.00 (One Hundred Thousand Naira) and above.

3.10 The Agent shall ensure that cardholders signs both receipts generated by POS terminal and shall compare with the signature behind the cardholder’s card. If the signature does not correspond, the Agent should not provide service to the cardholder and promptly notify PalmPay immediately.

3.11 The Agent should reject any unsigned electronic payment card for POS transactions.

3.12 The Agent report all suspicious transactions to PalmPay not later than 24 hours or the next working day.

3.13 The Agent shall check card security features prior to completing any transaction. Such checks shall include but not be limited to comparing card number on the card with the card number on the POS receipt or voucher.

3.14 The Agent shall compare the last four digits of the card number and name on the card with number printed by the POS terminal if the number differs, the Agent shall contact PalmPay immediately and should not release services to the cardholder.

3.15 The Agent shall ensure that card transactions are performed in a secure environment ensuring that the “card never leaves sight of cardholder” rule is strictly observed. Non-compliance with this will trigger the immediate cancellation of the Agreement and responsibility is passed to the Agent in case of fraud on the card(s).

3.16 In the event of a valid fraudulent transaction claim, the Agent would be charged 105% of the value of the claim if the Agent is found to be negligent in the area of enforcing cardholder identification at the point of receiving the cardholder’s payment card to be used on the POS terminal.

3.17 In the event of a valid fraudulent transaction claim, if the Agent is found to have connived with the perpetrator(s), the Agent would be charged 200% of the value of the claim, reported to the law enforcement agencies and/or blacklisted from POS transactions by regulatory authorities.

3.18 The Agent agrees to be responsible for all the actions of the principal and all its employees including fraudulent acts or omissions.

3.19 The Agent has consented to discretionary use of transaction and other Agent information obtained by Palmpay.

3.20 PalmPay may freeze the Agent’s Palmpay Agent and/or Palmpay account in an event where a fraudulent POS transaction is reported on the POS terminal deployed to the Agent’s location.

PALMPAY’S OBLIGATIONS

PalmPay shall:

4.1 provide the POS Terminals to PTSP for the development of the payment solutions application;

4.2 develop the payment solutions application for the POS Terminals;

4.3 be responsible for the software maintenance of the POS Terminals;

4.4 facilitate the acquisition of a terminal ID from the acquiring bank and advice PTSP in batches for configuration of the POS Terminals;

4.5 offer other support services for efficient and effective operation of this Agreement; and

4.6 be responsible for providing technical support to terminal users at the expense of the Agent.

4.7 ensure all POS terminals procured by PalmPay are compliant with minimum POS specifications.

4.8 cover the costs of repairs and replacements of parts for malfunction and damage of terminals caused by PalmPay.

AGGREGATOR’S OBLIGATIONS

The Aggregator shall:

5.1 Promote the deployment and service of POS Terminals to qualified Agents in accordance to existing laws and regulations in the Federal Republic of Nigeria.

5.2 Conduct the 1st round review of the KYC (“Know Your Customer)

Source: MoneyGistOnline